Wondering how to get a loan with no credit? Read this!

Applying for first-time loans can be nerve-racking for anyone. It’s even more so if it is for a first-time loan with no credit. There is so much information out there—both accurate and inaccurate—that it can be difficult to make financial decisions. If you’re looking for a no credit history loan, you don’t want to miss this article. I cover everything you need to know when seeking the best personal loans for no credit history.

It is common for people to need extra money sometimes. Whether it’s to cover an unexpected bill or to take care of an emergency expense, we all find ourselves in situations where we need a boost. In fact, 75% of Americans say that they’re not financially secure. The bottom line is you need money, be it $100 or $1,000. What’s holding you back is your lack of credit history. Don’t worry, it’s not the end of the world.

Never stress about an unexpected expense again.

Not having credit history can feel limiting at times. There are so many forms of credit that require credit history. Always remember that we all start somewhere. When it comes to applying for first-time loans, some lenders might require a credit history. Luckily for you, we don’t do that at Net Pay Advance. We are a trusted provider of loans for bad credit, low credit, or no credit at all!

Refresher: What are personal loans?

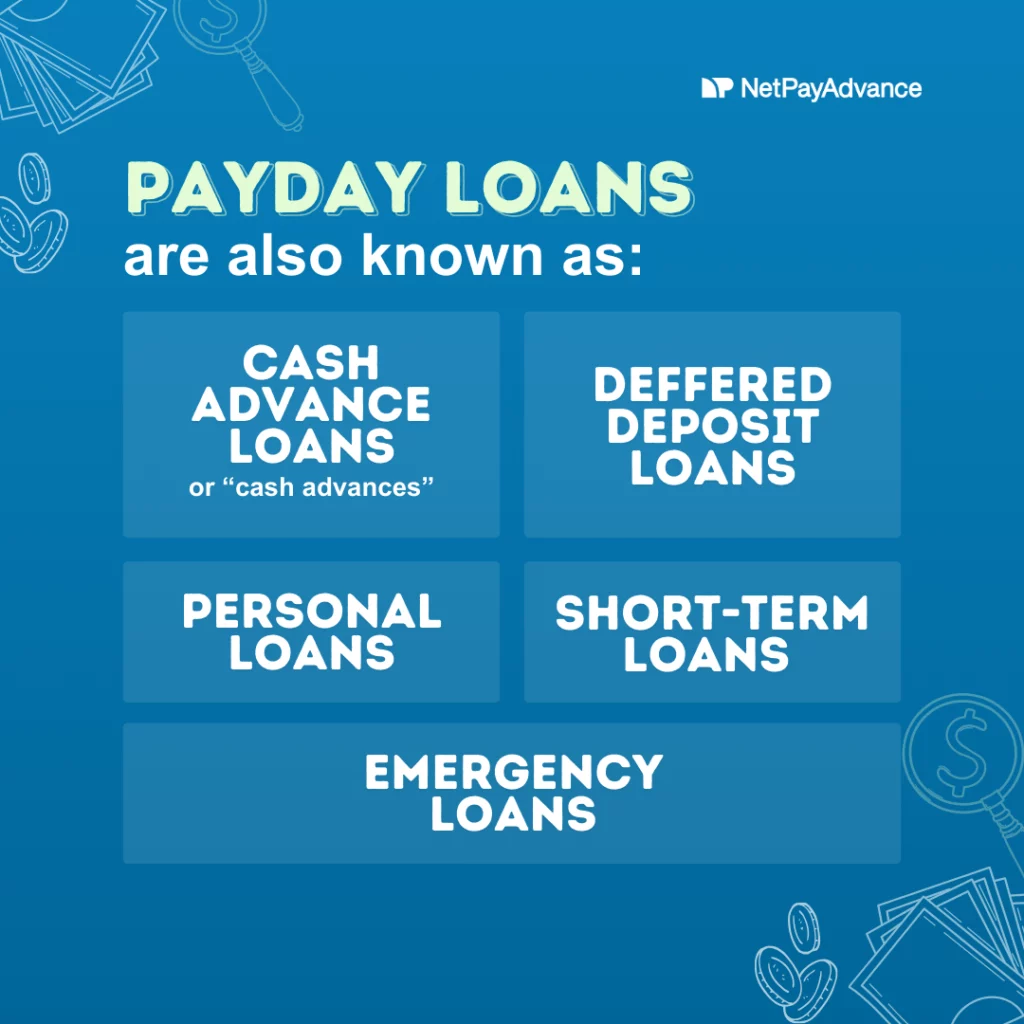

Before we dive in, I want to mention that personal loans can be called a few other names like online payday loans. Take a look at some other common terms:

Personal loans can also be referred to as “payday loans”, “deferred deposit loans”, “cash advances”, “short-term loans”, or even “emergency loans” depending on the borrower’s need for the money or geographical location.

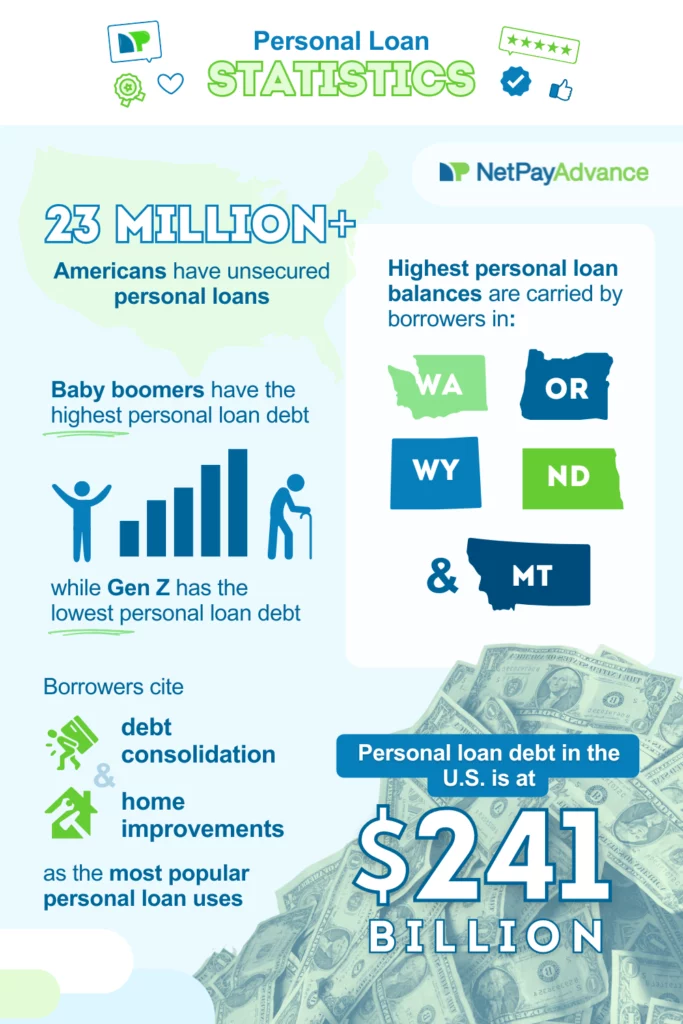

Personal loans are quite common. If you find yourself needing a personal loan, you’re certainly not alone. 23 million Americans have unsecured personal loans. “Unsecured” in the lending industry has nothing to do with the safety of the loan. In this case, “unsecured” just means that there’s no collateral backing up the loan, such as a home or car.

Unsure about personal loans? Well, these personal loan statistics will blow your mind!

In this article, we will answer questions related to first time personal loans no credit history along with tips to follow as a first-time borrower.

Can you get first time personal loan with no credit history?

The short answer is yes! It is possible to get first time personal loans with no credit history.

Work with a payday lender that doesn’t hold your lack of credit history against you. At Net Pay Advance, our mission is to help you by offering on-the-spot loans with no credit check barriers.

Don’t be mistaken, there is still an application. Afterall, there’s no such thing as guaranteed payday loans. You must submit a quick and easy online application and may get approved depending on your ability to repay the loan rather than your credit score.

Net Pay Advance gets applications for first time loans quite often. First-time applicants can apply just like anyone else. This is because we don’t consider your credit score when applying. Our application has no hard credit check, and there’s no credit needed to apply.

Should I take out a personal loan?

Nobody knows your needs or finances better than you do. It is entirely up to you to apply for a no credit history loan. You could also consider personal loan alternatives like borrowing from family, dipping into savings, selling items on eBay, etc. I would suggest you do what works best for you in your unique situation.

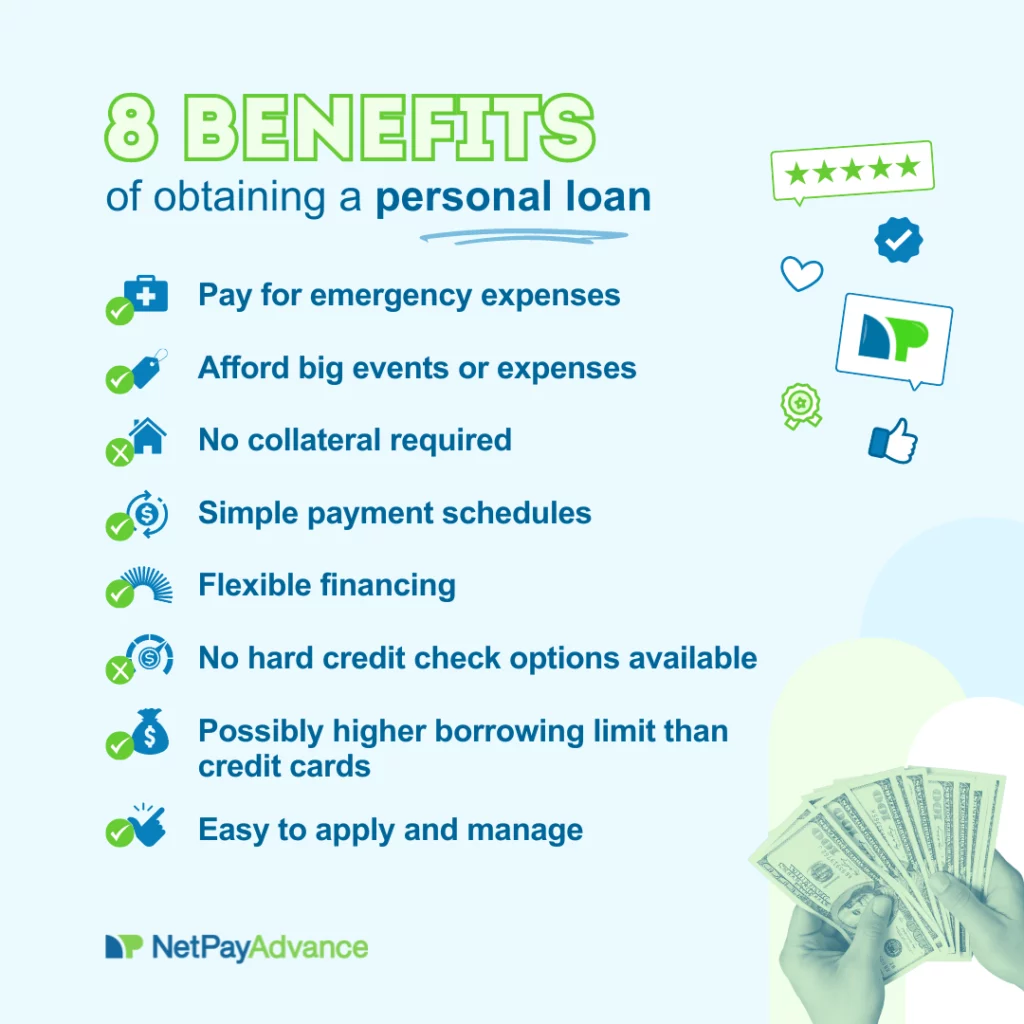

Ultimately though, there’s a reason millions of Americans ultimately turn to personal loans. Take a look at a few benefits of getting a personal loan.

If you need money within the day, a short-term loan might be the way to go. Net Pay Advance knows that sometimes life just can’t wait, and people need money ASAP! That’s why speedy approvals and quick transfer of funds are offered to borrowers including those seeking first-time loans.

Are there no credit check loans available for people looking for first time personal loans with no credit history?

It’s possible to get a loan with no credit history or bad credit. However, no credit check loans are a bit of a myth. While some lenders, like Net Pay Advance, don’t run a hard credit check, and don’t consider your credit score, they may still run a soft credit check to confirm the applicant’s identification. Your credit will remain unaffected if you apply with such a lender. If you have no credit or bad credit, it doesn’t matter to them.

In the US, 15.5% of Americans have a credit score below 600. That’s about 52 million+ people.

When you consider that an additional 45 million+ people don’t have any credit score, it’s easy to see why there’s a need for personal loans for those with bad credit or no credit.

Will I need a cosigner?

No, you don’t need a cosigner. A common misconception when seeking first time personal loans no credit history is that one needs a cosigner. That is not true at all when you work with a lender like Net Pay Advance, where credit doesn’t matter.

Tips for comparing loan options as first time borrowers

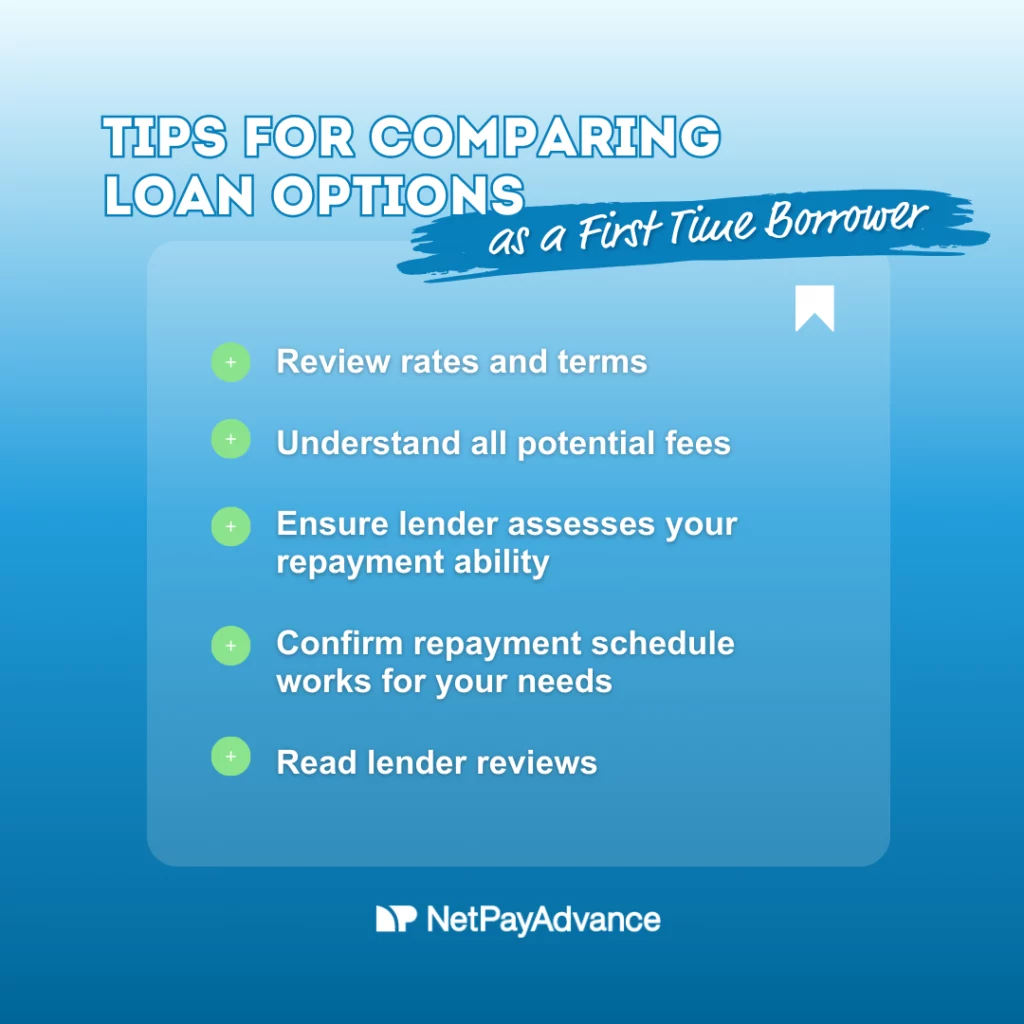

When applying for first-time loans, be mindful of a few things before you sign that dotted line. Take a look at these tips to get the best personal loans for no credit history:

1. Carefully review rates and terms

Never sign a document without reading it thoroughly. This applies to just about any document you sign. Reading the rates and terms will clarify what your payment schedules will look like, what fees are involved, what penalties, (if any) are imposed for missed or overdue payments, etc.

An important step in your quest for first time personal loans for no credit history is picking a legit direct lender. Try to verify their authenticity by looking up their license information.

2. Understand all potential fees

Be aware of what fees are associated with your loan and how much they amount to. You want to avoid shocks and surprises when it comes to money. Working with a lender that is transparent about costs is key. You want an honest and upfront lender to have a pleasant experience.

3. Ensure lender assesses repayment eligibility

Some lenders may claim to offer guaranteed approvals or waive off every requirement. These are too good to be true and far from what is real. For example, it is standard for a lender to require borrowers to be legal adults and reside in a state where they are licensed to lend. A lender can be based out of anywhere in the country, but they need to be legally permitted to offer loans in your state. See if we offer loans in your state:

See which loan options are available in your state

4. Confirm payment schedule works for your needs

People often neglect this detail. Believe me, this is crucial. You want a payment schedule that aligns with your payday cycle. That way you don’t have to worry about making payments when you’re running low on cash.

5. Read lender reviews

Look up online reviews and see what customers say about a lender. This helps establish credibility and trust. You want to work with a lender that other people had positive experiences with, don’t you?

Net Pay Advance has over 8000 positive reviews!

How to get a loan with no credit?

When seeking first time personal loans no credit history, the last thing you need is rejection. That’s why you need to find a lender who offers soft credit checks for first time personal loans no credit history.

Hard credit checks can negatively impact a borrower’s credit. We suggest steering clear of lenders who conduct them. Instead, go for lenders that carry out soft credit checks. Soft credit checks have no impact on a borrower’s credit. They’re done to confirm the applicant’s identity.

Final thoughts

Not having a credit history shouldn’t keep you from getting the help you need, especially when you’re dealing with a financial crisis. Regardless of what contributed to your financial situation or lack of credit, you deserve a fair shot at taking care of your expenses. Net Pay Advance makes it possible for you and scores of borrowers to get first-time loan with no credit!

Credit is still an important element of your finances. Even if you don’t have credit currently, we recommend getting started on understanding credit scores and working towards building a solid credit history. Raising your credit score will help open more doors for you, and did you know you can get a free annual credit report?

I strongly suggest checking out our payday loans resource hub for information on all things related to money, finance, and more!